|

|

| Help | |

| You are here: Rediff Home » India » Business » Special » Features |

|

| ||||||||||||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||||||||||

We have toyed with the idea for a long time. Should we rank the unit-linked insurance plans (Ulips) in the market? The idea is exciting simply because it has never been done in India before.

The idea is good because it allows an investor a handle with which to hold the product. Also, the idea is very daunting because comparing insurance policies is like trying to unravel a noodle soup. The more you stir, the more complicated it looks.

After discussing with the regulator, some industry leaders and those close to the insurance sector, Outlook Money decided to bite the bullet and get on with the ranking.

This is where we realised what an overwhelming task we had taken on. Just comparing the return figure, as given by net asset value data, would be incorrect since a financial product is a function of cost and return. The minute we bring in costs, comparisons became almost impossible to carry out.

Unlike the mutual fund product that has a very simple cost structure, Ulips carry a greater number of costs (administration and mortality), in addition to the others.

The problem begins because all these costs are levied in ways that do not lend themselves to standardisation. If one company calculates administration cost by a formula, another levies a flat rate. If one company allows a range of the sum assured (SA), another allows only a multiple of the premium. There was also the problem of a varying cost structure (as it should be due to the mortality cost part of the insurance premium) with age.

To cut through the confusion and yet be relevant to you, we took illustrations from all 14 life insurance companies for their Ulips for ages 30 and 45. We assumed that a 30-year-old was taking a 20-year policy for an SA of Rs 12.5 lakh, paying an annual premium of Rs 50,000.

And a 45-year-old was taking a 10-year policy for an SA of Rs 7.5 lakh with the same premium (see How We Did It). Premiums are paid throughout the term. We also assumed that only the growth, or the fund with up to 100 per cent equity allocation, is chosen.

We have been forced to remove Life Insurance Corporation of India, Aviva [Get Quote] Life Insurance, Max New York Life, SBI [Get Quote] Life and Birla Sun Life from our ranking since LIC [Get Quote] does not have a policy currently alive that allows for a long premium-paying term to fit in with our sample. Neither Max New York life, nor Birla Sun Life have fund options with 100 per cent equity exposure that have been running for more than one year.

The unit-linked plans of Aviva Life are currently being phased out and the insurer is in the process of developing new products. We found a major discrepency in SBI Life's illustrations.

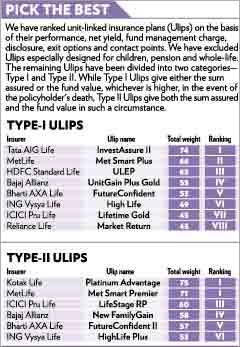

Left with only nine companies, we looked at Type-I and Type-II policies. A Type-I policy just gives the higher of the sum assured or the fund value, making the policy buyer extremely vulnerable to a small corpus in case of an untimely death in the early part of the plan. A Type-II policy gives both the sum assured and the fund value, and sure, it costs more too.

We then looked at the actual return and the internal rate of return to see which policy would give the best post-cost return. And, since the privatised insurance industry in India is so young, we have been forced to do a comparison of fund performance over a one-year period.

Ideally, a return history of three years should have been considered. But just five schemes would have qualified that way. We bring you rankings on a one-year return now, but will be able to give you a better handle with each passing year as the industry builds track record and experience.

The result

The winner in the Type-I category is Tata AIG Life's InvestAssure II, which has scored primarily because its one-year return, at 72 per cent, was way above the benchmark return of 53 per cent of the BSE Sensex.

This despite the fact that it has a fund management charge of 1.75 per cent, more than double the 0.8 per cent that HDFC [Get Quote] Standard Life charges. In fact, HDFC Standard Life has done very well on the cost parameter.

The insurer is clearly the lowest cost one in our examples, but has lost out due to underperformance over the time period. At returns of 42.7 per cent, HDFC Standard Life has underperformed the benchmark by about 10 percentage points. In fact, Tata and Bharti have outperformed the index by 10 percentage points or more.

Four companies were unable to beat the benchmark over a one-year period. In Type-II policies, there is much less competition, with just six companies in the fray. Kotak Life's Platinum Advantage is the winner and has a nice mix of lower costs and decent returns. It has consistently outperfomed the benchmark.

The insights

As we got our hands full of the innards of the insurance industry, we also got some insights that are worth sharing. Outlook Money believes that the insurance industry has some way to go in terms of transparency, disclosure and standardisation. The following are the gaps we found between the ad-speak and the reality in unit-linked products.

Lack of flexibility in life cover. Ulips are known to be more flexible in nature than the traditional plans and, on most counts, they are. However, some insurance companies do not allow the individual to fix the life cover that he needs.

These rely on a multiplier that is fixed by the insurer. For example, a 30-year-old will be forced to take an SA of Rs 11.25 lakh in Tata's InvestAssure II policy since the SA is 22.5 times the premium.

Overstating the yield. Insurance companies work on illustrations. They are allowed to show you how much your annual premium will be worth if it grew at 10 per cent per annum. But there are costs, so each company also gives a post-cost return at the 10 per cent illustration, calling it the yield.

For us, the most startling discovery was that some companies were not including the mortality cost while calculating the yield. This amounts to overstating the yield. We have done the calculations ourselves and then calculated the yield for this ranking.

Internally made sales illustration. During the process of collecting information, it was found that the sales benefit illustration shown was not conforming to the Insurance Regulatory and Development Authority (Irda) format.

The practice, it seems, is still prevalent in many locations30 per cent return illustrations are still rampant. During the process of collecting information, we found out that future return projections in the illustrations were not sticking to the 6 and 10 per cent stipulated by Irda.

Not all show the benchmark return. To talk about returns without pegging them to a benchmark is misleading the customer. Though most companies we found were using the Sensex, BSE 100 or the Nifty as the benchmark, or the measuring rod of performance, at least four companies are not using any benchmark at all.

Type-II plans still few. Outlook Money believes that an insurance policy's chief aim is to protect the financial future of the family of the insured, starting from the day of the policy, and not from year 10 or 15. This makes a policy that gives the SA plus the fund value as death benefit superior to the one that just gives the fund value.

The fund value will be small in the first seven to 10 years of the policy term and will not serve as a good insurance product. We found that just six of the 14 companies offer such a plan. Few more exist, but are in the nature of whole-life plans.

Early exit options. The Ulip product works over the long term. The earlier the exit, the worse off is the investor since he ends up redeeming a high-front-load product and is then encouraged to move into another higher cost product at that stage. An early exit also takes away the benefit of compounding from him.

An early exit option in a unit-linked plan shows how the product is structured. We found many products that clearly encouraged product churn by giving too many zero cost options to get out of the policy after the mandatory holding period was over. There are others, like the plans from MetLife, which encourage a longer holding term.

Creeping costs. Since the investors are now more aware than before and have begun to ask for costs, some companies have found a way to answer that without disclosing too much.

People are now asking how much of the premium will go to work. There are plans that are able to say 92 per cent will be invested, that is, will have a front load of just 8 per cent. What they do not say is the much higher policy administration cost that is tucked away inside (adjusted from the fund value).

While most insurance companies charge an annual fee of about Rs 600 as administration costs, that stay fixed over time, there are plans that charge this amount, but it grows by as much as 5 per cent a year over time. There are others that charge a multiple of this amount and that too grows.

Incorrect FMC. Another startling revelation was that illustration benefits of certain insurers did not have the provision of taking the relevant percentage value of FMC for the fund option chosen. The illustration will use the debt fund FMC, which is lower, even in an equity fund calculation, overstating the final corpus. This leads to a big difference in the maturity value causing misleading results.

Non-standard illustrations. At the last minute, we had to drop SBI Life from our rankings since their illustrations data differs across various sources. The data taken from the company itself, taken from the website and that from the agent show varying allocation for the FMC.

The FMC is important because over the long term a difference of even 0.5 per cent each year charged to the growing investment will make a huge difference in the final corpus.

The difference in the corpus in this case was Rs 3,53,299 lakh. ING Vysya Life, too, uses its fund management charge in the illustrations in a peculiar way. The illustration is made on the basis of 1.15 per cent FMC a year, although the applicable FMC on the equity fund is 1.5 per cent. This causes the final corpus to be overstated.

We have taken the first step in bringing a handle to hold the Ulip product. We invite you the investor, the industry and the regulator to add to this process with suggestions and comments.

With reports from Bridget S. Leena and Nikhil Menon.

More Specials

Powered by

|

|

| © 2008 Rediff.com India Limited. All Rights Reserved. Disclaimer | Feedback |