The Reserve Bank of India [Get Quote] increased the cash reserve ratio by 50 basis points on 17 April to reduce liquidity and control inflation. "Tighter money might push up lending and deposit rates," says Pralay Mondal, country head (retail assets and credit cards), HDFC Bank [Get Quote]. So what does that do to your home loan?

At this juncture, floating rates are likely to go up. If they do, your loan tenure or EMI, or both, will increase also.

If you decide to switch from floating to a fixed rate or change your lender in that scenario, factor in the costs before making a move. Renu Sud Karnad, joint managing director, HDFC, says: "The conversion fee could be 1-2 per cent of the outstanding loan amount. If one decides to change the lender, the foreclosure penalty as well as the processing charges on the new loan might defeat the purpose." Are there ways to minimise the impact?

If you decide to switch from floating to a fixed rate or change your lender in that scenario, factor in the costs before making a move. Renu Sud Karnad, joint managing director, HDFC, says: "The conversion fee could be 1-2 per cent of the outstanding loan amount. If one decides to change the lender, the foreclosure penalty as well as the processing charges on the new loan might defeat the purpose." Are there ways to minimise the impact?

Don't fix rates as floating rates are are 100-200 basis points cheaper than fixed rates and you can gain if rates fall. In any case, 'fixed' rates, too, are adjustible.

Also feature in the tax breaks. For the first house, you get a tax break of up to Rs 100,000 on the principal repayment and Rs 150,000 on the interest.

If you haven't used up this limit, then a higher EMI will only mean higher tax benefits. But make sure you have enough funds to pay for higher EMIs.

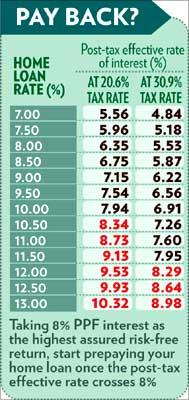

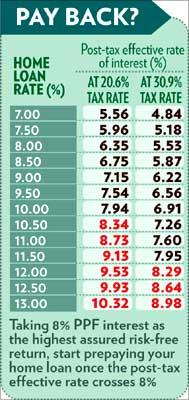

While prepaying factor in tax breaks. Your post-tax effective home loan rate will change according to the tax slab you are in (see table). You should start prepaying once the effective rate crosses the assured risk-free return rate of PPF. Prepaying helps hold EMIs at a fixed level.

More Specials

Powered by

If you decide to switch from floating to a fixed rate or change your lender in that scenario, factor in the costs before making a move. Renu Sud Karnad, joint managing director, HDFC, says: "The conversion fee could be 1-2 per cent of the outstanding loan amount. If one decides to change the lender, the foreclosure penalty as well as the processing charges on the new loan might defeat the purpose." Are there ways to minimise the impact?

If you decide to switch from floating to a fixed rate or change your lender in that scenario, factor in the costs before making a move. Renu Sud Karnad, joint managing director, HDFC, says: "The conversion fee could be 1-2 per cent of the outstanding loan amount. If one decides to change the lender, the foreclosure penalty as well as the processing charges on the new loan might defeat the purpose." Are there ways to minimise the impact?