|

|

| Help | |

| You are here: Rediff Home » India » Business » Report |

|

| |||||||||||||||||||||||

|

| |||||||||||||||||||||||

In the past three years, we have witnessed one of the sharpest rises in real estate prices in India, after the bubble in the mid-1990s. In the same period, more so in the last year, many 'real estate' companies (not sure how many are 'real', though) have seen dramatic increase (followed by a fall) in their valuations.

Let us put things in perspective. The presentation made by Housing and Development Finance Corporation has time and again, maintained the fact that shortage of dwelling units in India is in the vicinity of around 19 m (there has been a marginal fall in the same, but not a very meaningful one). So, the demand side has never been an issue. Ultimately, every individual dreams of owning a house at some point in his life.

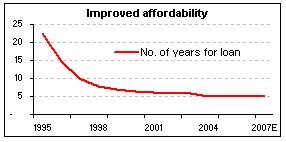

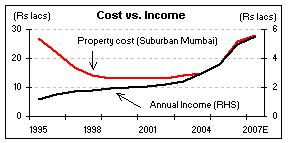

In our view, it is important to focus on the 'affordability factor', which is determined by broadly three parameters i.e. the property cost, income levels and interest rates. Prior to 2005, it is a known fact that the fall in interest rates on housing loans and income tax sops to individuals on housing loan repayments, boosted demand for housing in the country.

The graph below (Source: HDFC presentation) highlights the trend in property prices in South Mumbai, the income growth and the affordability (affordability here is derived by dividing the cost of the property by average annual income). As is evident, the rise in income accompanied by a decline in property prices, till 2000, resulted in property being 'affordable' for individuals. After remaining stable till 2002, property prices starting accelerating at a faster pace led by robust demand, with supply still lagging.

- Click here to download the Money Simplified issue - Real Estate & You

But if one were to extrapolate HDFC's figures post 2004 (these are our assumptions), property prices in Mumbai have more than doubled (depending upon the location). Assuming a 9 per cent growth in annual income of households in general, it is clear that property is not that affordable as it is made out to be. This is because prices have skyrocketed and the supply side is still lagging (in terms of good quality construction).

Add to this the fact that interest rates have started moving up in the last one year. With further rate hikes on the anvil, we expect affordability to worsen even further. While we are not trying to predict property prices, basic economics tells us that demand tends to slow down when prices start accelerating beyond affordability.

Real estate fundamentals

Demand drivers for real estate

Demand supply-gap for quality residential housing, favourable demographics, rising income levels, availability of financing options as well as fiscal benefits available on availing of home loan are the key drivers supporting the demand for residential construction. In addition to this, demand for office space from the IT/BPO (business process outsourcing) segment is expected to continue due to emergence of India as a preferred outsourcing destination. Also, buoyancy in organised retail is expected to result in huge demand for real estate construction.

Key parameters for selecting a real estate stock

For an average investor, size of the 'land bank' remains the sole criterion for investing in real estate companies. More often than not, their decisions are based on these land banks with little or no importance attached to the execution time and the margins of the projects. While land banks definitely give an indication of visibility in growth of the company's revenues, there are a few other factors that investors need to consider before investing in stocks from the sector. These include:

Management: Though management is an important criterion for investment across the sectors, we believe that the same assumes greater significance in the real estate industry considering the poor disclosure standards followed by the companies.

Management: Though management is an important criterion for investment across the sectors, we believe that the same assumes greater significance in the real estate industry considering the poor disclosure standards followed by the companies.

Key ratios: Not giving much importance to the land bank, investors should focus on working capital to sales (considering high gestation period of projects), debt to equity, operating margins and return on capital employed ratios. Also, considering the huge amount of funding required for timely execution of projects, investors should also keep a check on the possible dilution in equity, going forward.

Valuations: We believe that 'price to earnings ratio', is an appropriate metric for valuing construction companies. Besides, investors can also use 'price to sales ratio' for valuation purpose. As we have explained earlier that 'land bank' should not be 'the' key criteria for looking at real estate stocks.

Also, while valuing such companies, one has to practice caution. When valuing a real estate company, taking the 'best' price per square foot skews the investment decision in favour of risks. It is therefore, pertinent to value real estate companies based on a 'normalised' square foot price. It is also important to focus not just on the 'price per square foot' but also the 'profit per square foot'. This is because real estate developers increase prices also because of higher input costs (including legislative policy changes).

Some pitfalls

With respect to real estate stocks, a new theme has emerged in the Indian equity markets - 'land banks'. In order to meet the rising demand for homes and commercial spaces in a fast developing economy, construction activity has reached feverish levels in the country.

Not only real estate companies but companies from other sectors having free land for development are also witnessing significant appreciation to their market values on the back of expectations that the free land would eventually be developed and monetised.

While there is nothing wrong with this approach, the fact remained that even loss-making companies with poor fundamentals are witnessing a sharp run up in their market capitalisation and this kind of euphoria is really uncalled for.

As far as the real estate companies are concerned (companies with real estate development as their core business), these companies are entirely being valued based on their land banks i.e. the total land they own and no thought is being given to important considerations such as track record of the management, execution capabilities and balance sheet strength.

Further, even the lands are being valued using a high per square feet rate, presumably on the back of the assumption that they will keep on increasing indefinitely!

The risks with respect to investing in real estate stocks only get amplified considering that projects have high gestation periods and are highly capital intensive. Add to this the fact that there are no clear valuation methods available for valuing land accurately; not to forget, the highly varied costs of land in different parts of the country.

Powered by Equitymaster.com, an independent equity research initiative. Equitymaster is currently celebrating its 10th Anniversary. To know more about the special offers on its equity research subscription services, please click here.

|

|

| © 2007 Rediff.com India Limited. All Rights Reserved. Disclaimer | Feedback |